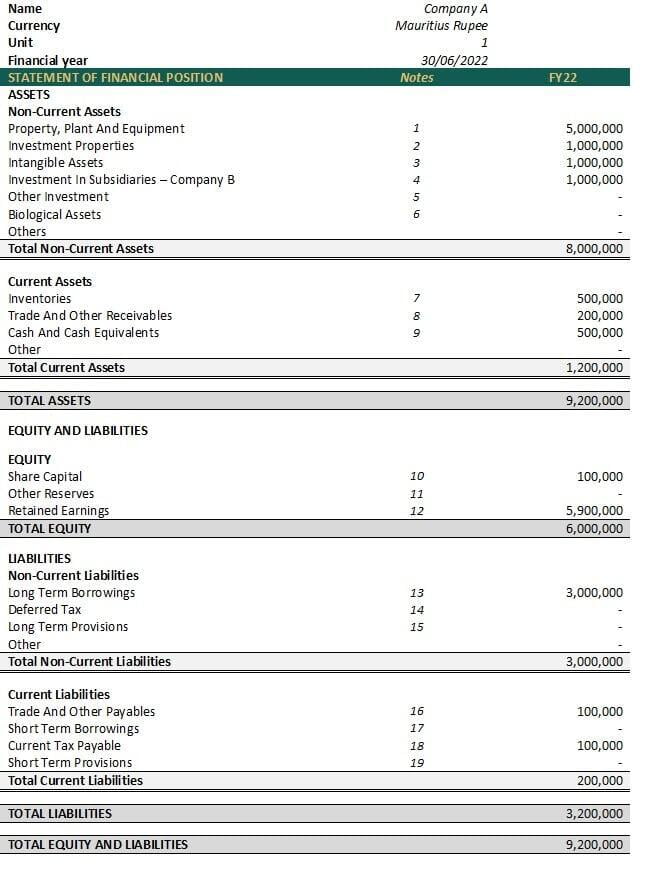

Get a better understanding on how to interpret a Statement of Financial Position

Statements of Financial Position (“SOFP”) also known as Balance sheets are, as opposed to Statements of Profit or Loss, Statements of Cash Flows and Statements of Changes in Equity, a snapshot of your business assets, liabilities and equity at a certain point in time and not over a period of time.

The objective of a SOFP is to provide a snapshot of a company’s Assets, Equity and Liabilities. Assets are the items owned by the business. Liabilities and equity are what your business owes to third parties and owners. The main accounting equation to know is “A = L + E” or assets equal liabilities plus equity.

The SOFP shown above is based on the Mauritius Corporate and Business Registration Department template filed and available online (https://onlinesearch.mns.mu/).

ASSETS

Non-Current assets

Non-current assets are all assets owned by the company for which lifetime are expected to be over a year.

1. Property, Plant and Equipment (“PPE”)

PPE refer to the physical/tangible non-current (lifetime of more than one year) assets of the company. Classic examples of PPE are buildings, vehicles, machinery, land, etc. PPE is accounted for using either the cost model (cost less depreciation or impairment) or revaluation model (fair value at the date of revaluation less subsequent depreciation and impairment, provided that fair value can be measured reliably).

e.g. The total value of all long-term assets after depreciation or PPE of Company A was Rs 5.0M in FY22.

2. Investment Properties

Investment properties, as opposed to PPE, are only buildings or land, acquired for the only purpose of earning rental income or capital appreciation. These properties are not used by the company itself as part of their normal course of business. On the books, the value of investment properties must be shown at the lower of fair value or cost. If the accounting treatment is the latter, the investment properties must be fair valued at end of each period.

e.g. Company A bought a plot of land worth Rs 1.0M in FY22. Land is not depreciated and does not lose value overtime. The land is accounted for at cost and therefore was not revalued.

3. Intangible assets

Intangible assets are non-monetary non-physical items that arise from legal or contractual rights. In addition, the assets must be separable (capable of being transferred or sold. Examples of intangible assets are Trademarks, Patents, Goodwill, etc. These assets are measured by an entity first at cost and then either using the cost model or the revaluation model.

e.g. Total intangible assets after impairment [cost method] (equivalent of depreciation but for intangible assets) of Company A was Rs 1.0M on a patent in FY22.

4. Investment in subsidiaries

Subsidiaries are companies owned at more than 50% by the parent company. The SOFP shows the total investment made by a company to acquire share in another company.

e.g. Company A acquired a controlling stake in Company B in FY22 for Rs 1.0M.

5. Other Investments

Any investment that do not fall under the above categories, such as direct investments, portfolio investments, financial derivatives and employee stock options, fall under other investments.

e.g. Company A did not invest in any stocks or derivatives in financial years prior to or during FY22.

6. Biological assets

Biological assets fall under accounting for agricultural activities and represent any living animal or plant value owned by the company.

e.g. Company A does not own any biological asset meaning that they do not operate in the agricultural industry.

Current assets

Current assets are all assets owned by the company for which lifetime are expected to be less than a year.

7. Inventories

An entity’s inventory represent the assets held for sale during normal course of business. The assets are not meant to be kept for longer than a year. Inventory is valued at the lower of cost and Net Realizable Value (“NRV”) which is the estimated selling price in the ordinary course of business less estimated costs necessary to make the sale.

e.g. Company A inventory value at FY22 year-end is Rs 500K, meaning that the lower of cost to acquire or NRV was Rs 500K.

8. Trade and other receivables

Receivables aredefined as the amount owed to the business by its customers following the sale of goods or services on credit. In other words, the amount that the entity will receive from its customers in a within a year.

e.g. Rs 200k is owed by customers to Company A at FY22.

9. Cash and Cash equivalents

Cash and cash equivalents represent the amount of cash and liquid assets (e.g. short term securities) that can be readily converted into cash (within 90 days).

e.g. In FY22, Company A’s cash and liquid assets amounted to Rs 500K.

EQUITY

10. Share Capital

Share Capital, also known as “Capital Invested”, is the amount financed by the owners in exchange for shares in the company.

e.g. Assuming that capital was injected only once to launch the business, the owners of Company A invested a total of Rs 100K to finance the start of operations.

11. Other Reserves

Other reserves comes in the form of revaluation reserves, fair value reserves, hedging reserves and different types of reserves that do not fit into other categories.

e.g. Company A did not revalue any assets and therefore does not have any value under other reserves.

12. Retained Earnings

As straight-forward as it sounds, retained earnings are simply the historical profit accumulated by the company that has not been paid in dividends.

e.g. Company A’s retained earnings stood at Rs 5.9M in FY22, meaning that the total historical undistributed profits add up to nearly Rs 6.0M.

LIABILITIES

Non-Current Liabilities

Non-current liabilities reflect the amount owned by the company for which lifetime are expected to be over a year.

13. Long Term Borrowings

Any type of loan repayable after a period of 12 months would fit under this category. The portion payable within the next year would not be accounted for as long term borrowing.

e.g. In FY22, Company A had Rs 3.0M of loan to repay in a time frame which exceeds 12 months, meaning past financial year end FY23.

14. Deferred Tax

Deferred tax are income tax payable at a later date due to taxable temporary differences. The liability is deferred due to a timing difference between when the tax was accrued and when it is meant to be paid.

e.g. Company A did not experience timing differences and has no deferred tax liability for FY22.

15. Long Term Provisions

Provisions are amounts set aside by the company to cover known liabilities that will incur in a medium to long term future.

Long term provisions are mostly amounts set aside for future repairs and maintenance or employees’ benefits payments at retirement.

e.g. Company A did not set aside a specific sum past FY22.

Current liabilities

Current liabilities are short-term obligations owed by the company for which lifetime are expected to be less than a year.

16. Trade and other payables

A company’s payables are the amount owed to suppliers during the normal course of business. In other words, the money owed within a year.

e.g. In FY22, Company A owed Rs 100K to suppliers.

17. Short Term Borrowings

Similar to long term borrowings but for a period of less than a year, Short term borrowings are any amount owed such as bank overdraft, within the next 12 months.

e.g. Company A does not rely on any short term loan for financing at FY22.

18. Current Tax payable

Contrarily to the deferred tax explained above, the current tax is the amount payable during the next financial year, as a result of the company’s financial performance during the previous year.

e.g. Company A’s current tax payable as per the FY22 statement of financial position is Rs 100K. Based on a 17% tax rate (15% income tax + 2% CSR), Profit before tax was approx. Rs 588K.

19. Short Term Provision

Following the similar logic, short term provision are the amounts set aside by the company to cover known liabilities that will incur in a short term future, as opposed to medium and long term for long term provisions.

e.g. In FY22, Company A did not set money aside for its known short term coming liabilities.

To sum up, the asset value showed on the accounts must be equal to the sum of equity and liabilities.

To get a deeper and clearer understanding of your company’s financial position, contact BYRD.