Learn more about the elements that comes into play when valuing a business

Why should I value my business?

Business valuations, no matter if done on a proactive or reactive basis, brings comfort and added value to shareholders or management of a business.

The reasons for valuing are numerous and from different nature, as shown below:

INTERNAL

- Financial reporting valuations (can be both internal and external)

- Taxation purposes

- Sale of equity

- Internal reward system

- Disputes and.or probate valuations

EXTERNAL

- Investment decisions (purchase of equity)

- Comparative analysis

- Capital raising

- M & A

- Loan approvals (SBA loans)

(ACCA Certificate in Business valuation)

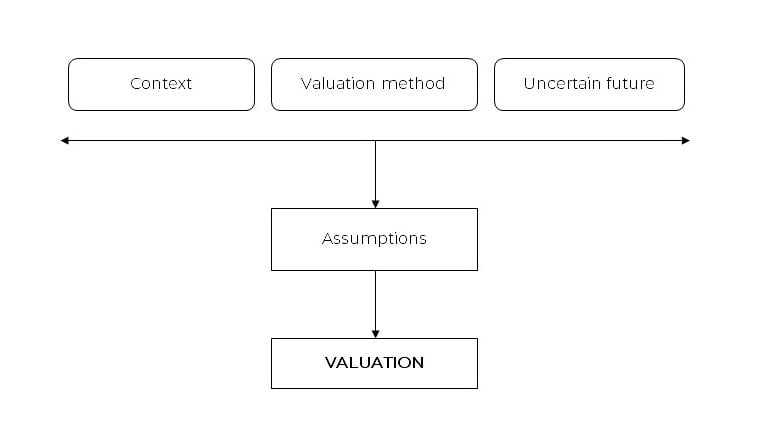

Context

Every valuation exercise starts by getting an understanding of the context in which the valuation is done and conditions under which the company operates. Both strategic analysis and financial analysis are required to comprehend the general background, sector and market, resources used and needed by the company, history, current and forecasted financials in order to perform the necessary adjustments if needed and pin-point potential issues going forward.

Methods of valuation

As a general rule, every method should be used. However, one method will be more appropriate than another for a business operating in certain industries.

To choose between Asset-based vs. Multiples based vs. discounted cash flows as prevalent technique, the valuer will have to ask a series of questions and apply his own judgement to determine the most appropriate method.

1) The Asset-based method is based on the assumption that a business is worth the value of the asset it owns.

2) The Multiples based method is built on the premise that similar assets sell at similar prices. Comparable peers need to be screened and identified for accurate valuations

3) The Discounted Cash Flows (DCF) method, is a forward looking approach, which assumes that an enterprise value should be based on its future cash flows.

Please note that all methods have advantages and disadvantages which must be taken into account when selecting the most relevant method to use.

Uncertain future

The uncertain nature of future prospects for any company is challenging when applying judgement. Valuations requires professional skepticism, objectivity and neutrality every step along the way.

Valuations are a complex exercise that require a thoughtful understanding of the business and approach.

BYRD Consulting will help you value your business and will act in capacity of expert during the whole process